Competitive Equilibrium

Oh, Hyunzi. (email: wisdom302@naver.com)

Korea University, Graduate School of Economics.

2024 Spring, instructed by prof. Koh, Youngwoo.

Basic Model

Consumers

Producers

- if

- if

- if

- set of feasible production plans.

- if

Allocation

- it is assumed that every resource belongs to someone.

Given

Ownership

- note that

Pareto Efficient Allocations

An feasible allocation

- Pareto Efficient does not concern with distributional issues.

An allocation

Note that the equalities hold at optimum since

- demand for good

where the second equality guarantees the unique

Let the allocation

Proof.Let

F.O.C.

Therefore,

- MRS for any goods

- MRTS for any goods

- MRS and MRTS for any goods

this completes the proof. □

Competitive Equilibrium

A feasible allocation

- Profit maximization:

- Utility maximization:

- Market clearing:

If

If

- Market clearing:

- Consumer's budget constraints:

then the market of good

Proof.From the market clearing condition, for all

Two-goods Economy

Suppose there are two goods (

- initial endowment:

- price of good

- consumer

- firm

Proof.let the price is given as

CE conditions:

- Profit maximization: for each

- Lagrangian

- F.O.C.

- if

- if

- if

- Lagrangian

- Utility maximization: for each

- Lagrangian:

- F.O.C.

- Lagrangian:

- Market clearing: by the ^2c4b14Theorem 7 (Walras law in CE), ISTS that the market clears for the good

Let

note that these conditions are determined independent to

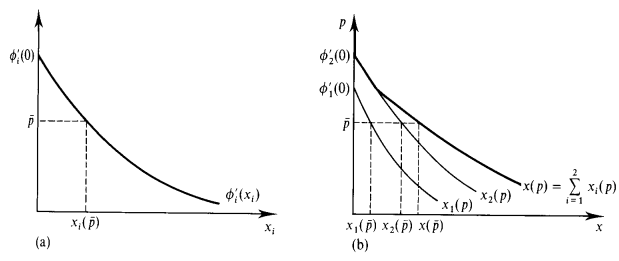

AD function:

since

the Walrasian demand function for consumer

the Aggregate demand function is

AS function:

since

the supply function for firm

the Aggregate supply function is

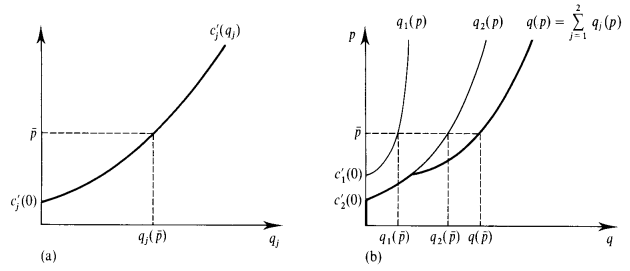

Equilibrium: at

Note that

- Marginal Cost function:

- Marginal social benefit:

this completes the answer. □

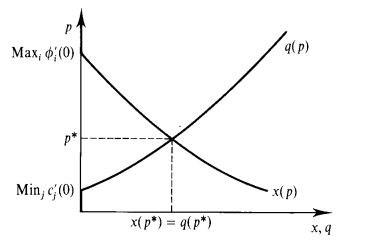

Robinson Crusoe Economy

Robinson, who lives in a desert island, works in the daytime (Robinson producer; RP) and consumes "consumption" and "leisure" in the remaining time (Robinson consumer; RC).

- RC's initial endowment:

- RC's utility:

- RC is the only provider of labor: he owns the firm.

- RP's production function:

Proof.let

CE conditions:

- Profit maximization: RP solves,

- F.O.C:

- profit function:

- F.O.C:

- Utility maximization: RC solves,

- F.O.C:

- F.O.C:

- Market clearing: by letting

this completes the answer. □

Welfare Theorems

- FWT(CE

- complete set of market: every relevant good is traded in a market at publicly known prices.

- price takers: every households and firms act perfectly competitive.

- SWT(PE

- household preference and firm production sets are convex.

- markets are complete

- every agents are price takers

- appropriate lump-sum transfers of wealth are arranged

If

Proof.

RTA: suppose that

since it is not PE, there exists a feasible

therefore,

since CE is PMP & UMP, there exists no other feasible allocation that can strictly increases the utility.

Suppose that

Proof.Consider a hypothetical economy

- define

- let

- let

WTS#1:

- from

- since

- as

- thus,

- as

- then, since

- by letting

WTS#3:

At PE, there is no other feasible allocation that can strictly increase utility. Thus there exists some PE that is also CE, where we can achieve by rearranging the wealth by lump-sum treasfering.